1.

Thanks to our worldwide partnership with American Express and Diners Club International we are able to provide credit lines to our clients.

2.

We are able to improve our customers and supplier’s cash flow.

3.

We can manage payments with over 100 different currencies.

B2B PAYMENT PROCESS

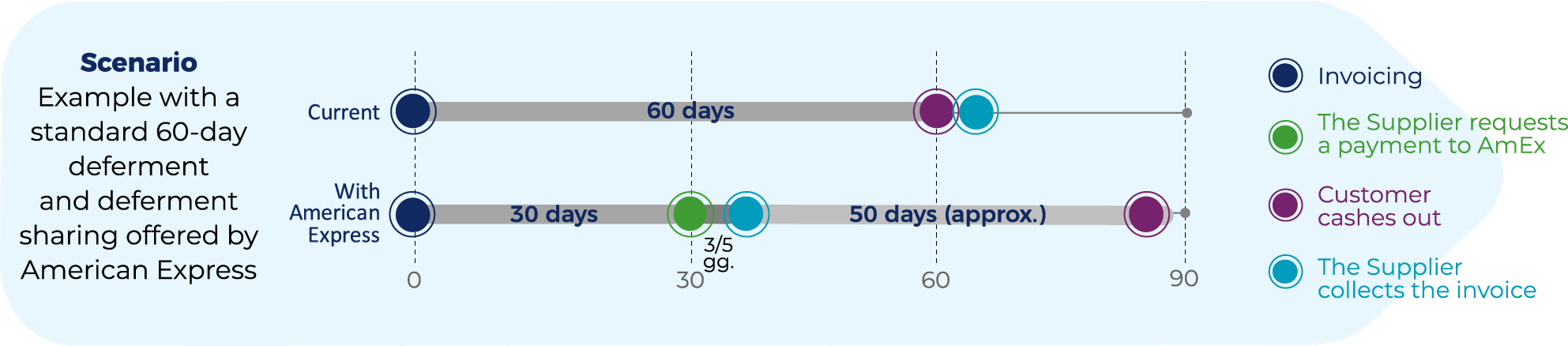

American Express can help reduce the Supplier’s Days Sales Outstanding (DSO) and increase the Customer’s Days Payable Outstanding (DPO).

IMPACT

Supplier

DSO reduction

-30 days

Customer

DPO increase

+28 days

with international gate

American Express has signed an agreement with International Gate to guarantee a longer deferred payment to its Customers to improve payment terms.

- Thanks to this collaboration, International Gate can offer its Customers, completely at no cost, an alternative payment method for supplies

- This is achieved thanks to a non-bank spending capacity - not visible in the Central Credit Register that AmEx assigns on the basis of the analysis of the Client's balance sheet

- The payment instruments are virtual and non-nominative corporate credit cards

- Thanks to payment by credit cards, the customer can enjoy an extension of up to 58 days on top under the conditions established with your supplier

- The deferral is achieved thanks to the 30 days of the card's accounting cycle + 28 days of effective financial deferral

- Once the transaction has been made, the Client will receive an account statement from AmEx which will be paid with a SEPA transaction at the end of the payment